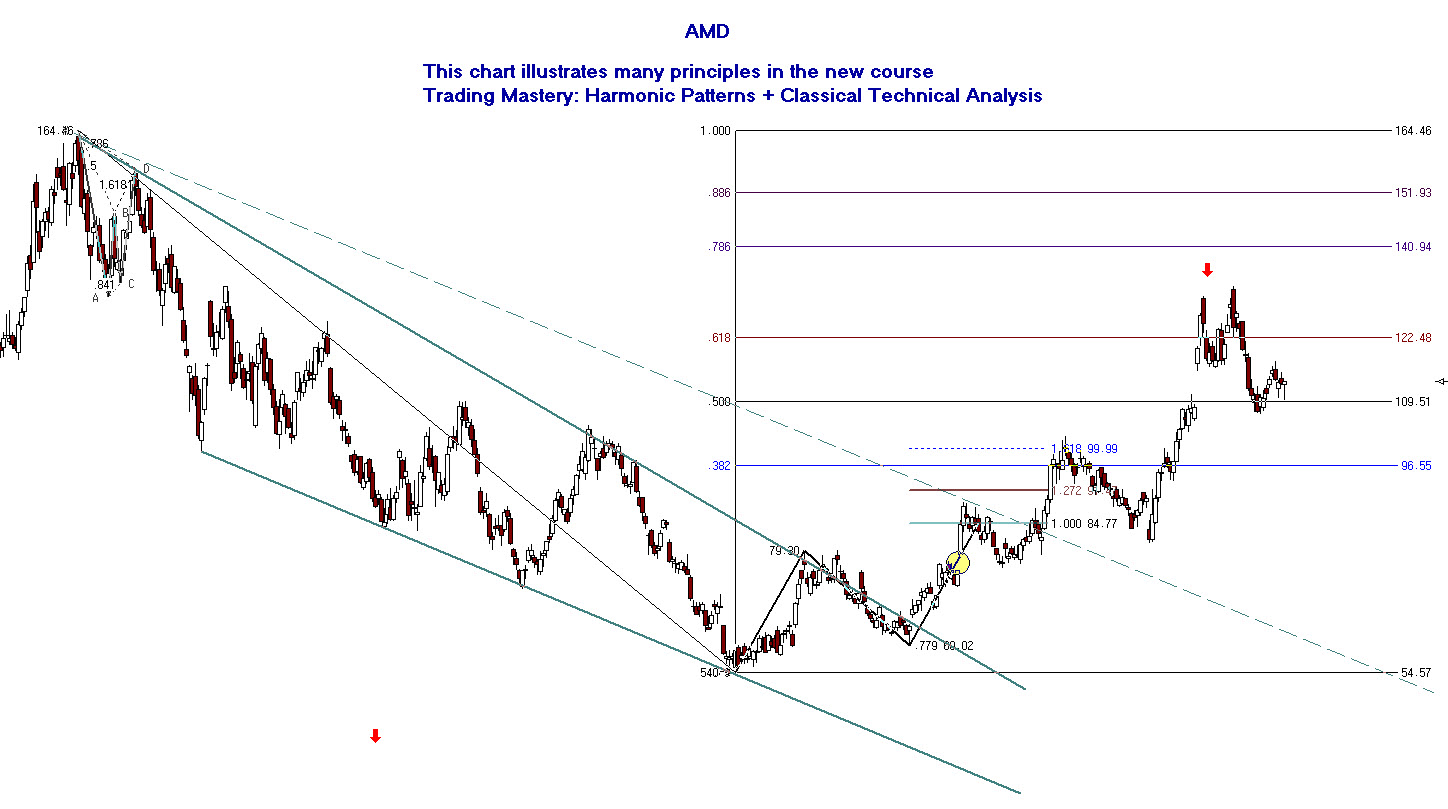

Description - Trading Mastery: Harmonic Patterns + Classical Technical Analysis

Workshop 1 - One Hour 14 Minutes Pattern Setups and Harmonics.

Traders often have errors when it comes to correctly identifying pattern setups and harmonic patterns. I show you what is correct and what is not. Many unnecessary losses come from errors in misidentifying patterns.

- Mindset tips with patterns. Method and mindset must blend together. I use real chart examples of patterns that have not yet completed and completed patterns and discuss what traders might be “thinking” as these patterns form that can lead to trading errors. Hesitating, talking oneself out of a setup, entry errors, etc. are just a few of the error’s traders experience.

- The BC leg extensions can be used with other ratios of patterns along with classical technical analysis to plan trading setups. This workshop illustrates how helps traders with trade execution.

- Steep slope and angles that form in the CD leg. They don’t always mean the pattern is invalid. I walk you through examples of when it may invalidate a trade setup and when there may be an entry for a trade setup.

- Multiple patterns can appear within larger swings and can help determine entry areas. I’ll show you how you can use multiple patterns to your advantage when planning a trading setup.

- Real chart examples are used with follow up in other workshops in this series.

Workshop 2 - One Hour Eighteen Minutes

Support and Resistance. This workshop combines classical technical analysis with harmonic patterns and teaches simple methods for identifying support and resistance levels. This is an extremely powerful tool for traders of any method. Traders using harmonic trading patterns such as the AB=CD, Gartley, Butterfly and Three Drive patterns will especially benefit from this workshop.

Potential trade setups utilizing these concepts are analyzed with chart examples of MSFT, NASDAQ (potential Gartley sell pattern), and the futures contract for the Dow Jones Industrials (YM).

Workshop 3 - One Hour Eighteen Minutes

Ranges versus Trends. The market structure and environment cannot be overstated as to the importance of recognizing and understanding trade tactics to traders. Market environments change however, many traders do not know how to identify or change tactics with these changes. Ranges and trend environments are discussed to help traders be on the right side of the market.

There is a progression of topics throughout the series and Workshop 3 encompasses the topics from Workshop 1 and Workshop 2 and looks at charts of NVDA, MSFT, GBTC, AMGN and others to illustrate the importance of identifying range trading and trend trading environments.

Workshop 4 - One Hour 7 Minutes

Reversal Patterns. “If traders can study the footprints of price reversal from down to up, and up to down they will gain skills in reducing losses and increasing gains.”

Six reversal patterns are taught. These patterns can lead to large wins and importantly avoiding losses. I teach several reversal patterns including methods for using the AB=CD pattern in reversal areas.

Real chart examples are used walking through these processes, step-by-step. This topic is a must to build all traders’ skills.

Charts with the Butterfly reversal pattern are used. I show you what “Ending Swing” patterns are using a SP 500 Emini chart and others. Once again, the concepts of the previous Workshops are combined.

Workshop 5 - One Hour Ten Minutes

Multiple Time Frames and Fractal Nature of Price. Learning to combine multiple time frames and understanding the fractal nature of price is a power tool for trade execution.

I show you how to use multiple time frames using real chart examples for both analysis and trade execution. You also learn how to apply harmonic and classical trading patterns within multiple time frames.

Also covered in this workshop are Index Divergences. This is especially pertinent to intraday traders of stock market index futures such as the S&P 500 Emini, the Dow Jones Industrials YM contract, and the NASDAQ futures.

Stock market ETFs such as SPY, QQQ and DIA could be used in place of the futures contracts.

Workshop 6 - One Hour Twenty-Five Minutes

Retracement Entries. There are specific market conditions and price action that favor retracement entries.

- I teach you what these market conditions are along with several retracement patterns traders can implement into a trading plan.

- You’ll learn the highest probability retracement entry trade setup.

- You’ll learn what the ‘5 outcomes of breakout trades’ are.

- You’ll learn about the “True” Gartley pattern. This is what H.M. Gartley wrote about in his 1935 classic book, “Profits in the Stock Market”.

This workshop also discusses “Hidden Errors”.

These errors are generally unknown to traders and I’ll show you an example of a real trader and his “Hidden Errors”. This will be eye opening as to how impactful these are to traders’ results.

This will be eye opening as to how impactful these are to traders’ results.

I am confident traders of all levels are going to increase trading skills, learn to identify higher probability trade setups and implement the material into any trading style.

CLICK HERE to Buy Now Includes 2-year access to all course materials.

Benefits & Why You Should Learn Trading from me.

- I hold the Chartered Market Technician (CMT) designation. This is the gold standard in technical analysis.

- I am a member of the Chartered Market Technician's Association.

- I've authored two published books - Trade What You See, How to Profit from Pattern Recognition, available in 6 languages.

- Essentials of Trading, It's Not What You Think, It's HOW You Think, (included in your Course Bundle).

- I've helped thousands of traders.

- I'm a regular contributor on StockCharts.com sharing my expertise.

- I have the experience and the skills to improve your trading, both method and mindset, and to navigate these volatile markets.

- You will learn proven trading setups for all markets and time frames.

- You will learn to identify trade setups early to plan trades, risk, and exit strategies.

- You will learn the powerful Butterfly reversal pattern along with 3 other repetitive trading setups.

- You will learn details about these trade setups not found anywhere else because of my 25 plus years' experience.

- You will increase your confidence learning this trading information.

- You will have 2-year access to course materials to study at your pace.

I believe in offering quality trading education at a reasonable cost.

You have to sign-up to get started today!

Testimonials

And so many times I take away new techniques and knowledge that I can realize a return on quickly. Your lessons are very valuable, literally! I truly hope that you continue to so generously offer your services and lifelong work to others like myself for many years to come. T. Pitman

The Intro to the Pattern Recognition class has indeed helped me understand that the markets do indeed move in an orderly fashion. I think that any trader, should be introduced to these concepts first within the context of market structure. M. Billings

Always amazed by the combination of technical tools that form your method and allow you to come up with clear conclusions. Jean-Marc

I have been trading harmonic patterns for a long time. This course doubled my knowledge of trading the patterns overnight. Thanks, Leslie, for sharing your knowledge. Kyaw Htay

CLICK HERE to Buy Trading Mastery: Harmonic Patterns + Classical Technical Analysis

Best Wishes for Successful Trading!

Leslie Jouflas, CMT

Questions? email: ljouflas@msn.com

Disclosures Trading Live Online, LLC is not registered with the CFTC pursuant to the exemption provided in the CFTC Rule 4.14(a)(9) as the firm provides non-customized commodity trading advice through a system subscription service and does not direct client accounts. IMPORTANT: The risk of loss in trading futures, options, cash currencies and other leveraged transaction products can be substantial. Therefore only "risk capital" should be used. Futures, options, cash currencies and other leveraged transaction products are not suitable investments for everyone. The valuation of futures, options, cash currencies and other leveraged transaction products may fluctuate and as a result clients may lose more than the amount originally invested and may also have to pay more later. Consider your financial condition before deciding to invest or trade